You have been adulting for quite some time now, and this is the time to act responsible financially as well.Get your finances on track by choosing the best investment option that will support you for the next phases of life.

As a young individual, when you start working, you may tend to get overboard with the way you spend your income. In a world of enticing things to buy, young salaried professionals often have a difficult time dealing with their insufficient earnings. Even if someone has a fat salary package, they end up living pay cheque to pay cheque, thus saving little or none in the process.

Youngsters are always advised on saving for the future, but not about investment. Only a minority of young professionals take the road less travelled. If you haven’t started investing yet, it’s time to upgrade your lifestyle and take your financial planning to the next level by exploring the best investment options by our expert financial advisers and a team of CA who may review your current earning and help you to choose the right investment plan to save tax and get maximum assured returns.

Below are Some of The Investment Options:

Buy an Insurance: As you get ready for the next phase of your life, getting married and starting a family, you will have to act more responsible financially. Financial security of your family should be your priority; hence, you should buy a term life insurance. Buying insurance is a pure investment option that will save your family from financial troubles in your absence. Moreover, you can get tax deductions under Section 80C of the Income Tax Act.

Tax-Saving Deposits: There are a plethora of tax-saving deposit options like Fixed Deposits (FD), Recurring Deposit (RD) and Delightful Deposit. The deposit allows you to save for goalposts. You can earn better interest rates on the account types. You can choose a riskier investment option like Equity-Linked Savings Scheme (ELSS). This is the only mutual fund tax-saving solution that helps you earn high returns.

Mutual Fund Investment: When you’re an adult, you need to know that investing is a wise choice to brace yourselves for the next phases of life, such as marriage, buying a home or retirement. When it comes to long-term investment option, mutual fund scheme is a suitable option. Our financial advisers may give you the right tips for getting higher returns in the future.

Pension Plans for Retirement: You should plan for retirement at an early age. You need to determine how much money would be sufficient for the post-retirement phase. Your current income and expenses are the two factors that will help you ascertain the estimated retirement corpus. It is best to start investing in National Pension System (NPS) or Employee Provident Fund or Public Provident Fund (PPF) so that there is no stop to the regular source of income, and you can live a happy retired life ahead.

These are some of the investment options young working professionals can choose to grow wealth and secure their future.

Small Investment, Big Returns

Invest in physical assets such as commercial and residential properties , vehicles, equipment and furniture and lease your physical assets to corporates, to earn great returns. We can help you to choose the best physical assets as per your investment budget to earn higher returns and secure your future.

OUR TRACK-RECORD

| Average IRR

21% |

Average Investment

₹ 72,000 |

On Time Payment

100% |

Diversify your portfolio starting |

Attractive rate of returns |

|

Why you should invest through us on a physical asset ?

-

Detailed Analysis: Unique investment opportunities qualified through rigorous due diligence

-

Complete Transparency : Disclosure of all aspects of each investment, terms of lease and potential risks

-

Established Co-Investors : Reputed investors invest at least 30% of the total investment amount for each asset

-

Seamless Process :Investment identification, execution and management delivered at your fingertips by our expert advisors

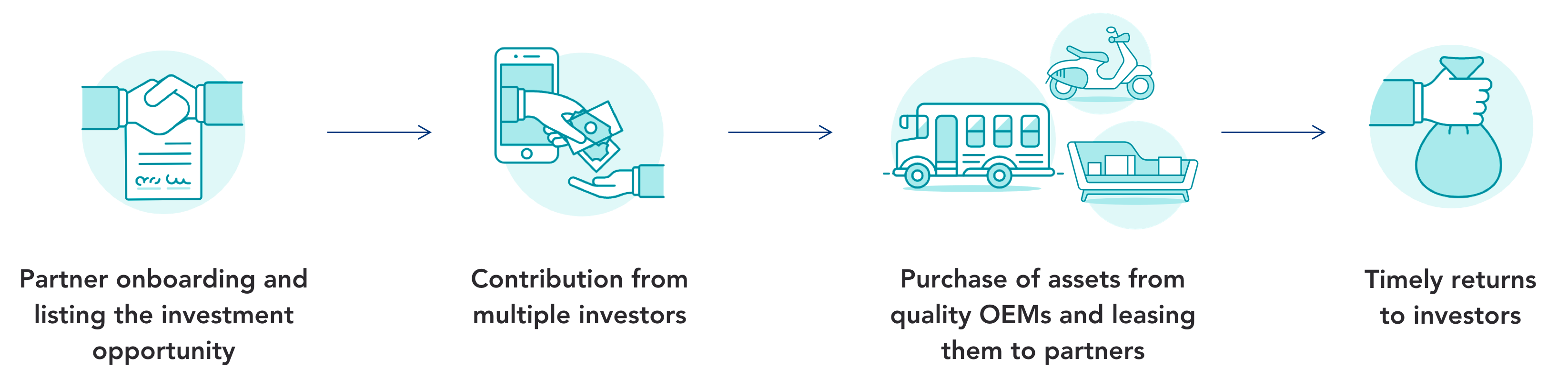

How it Works?

Why Leasing?

- Predictable returns : Pre-agreed monthly payments for the full lease tenure with no day to day volatility like stock markets

- Strong Collateral :Upfront security deposit as well as the ability to recover, re-lease or sell assets to mitigate risk

-

Tax Benefits : Ability to claim depreciation and expenses to reduce the effective tax rate for lessor (you)

Still Curious?

Fixed, non market linked returns

Fixed, non market linked returns